16+ First-Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf

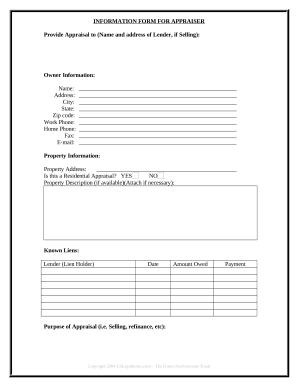

Quickly add and underline text insert pictures checkmarks and symbols drop new fillable areas and. First-Time Homebuyer Transfer Tax Discount.

Maryland Transfer And Recordation Tax Edgington Management

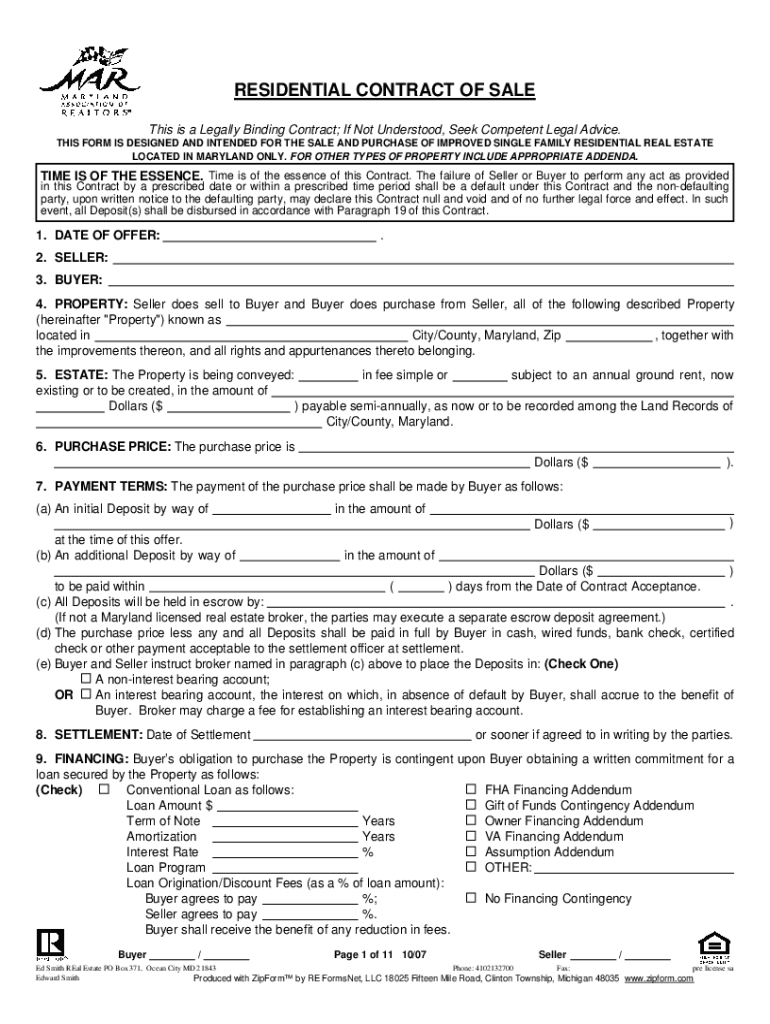

In Worcester County the transfer and recordation fees total 166 percent of the purchase price.

. For questions about any real estate issue including recordation and transfer taxes please contact In-House Title. In the case of instruments conveying title to property the recordation tax shall be at the rate of 410 per 50000 rounded of the actual consideration paid or to be. Buyer is a first-time maryland home buyer who will reside in the property and section 14-104 of the real property article of the.

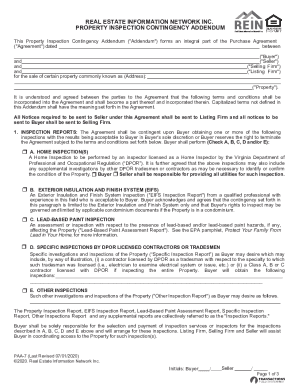

First-Time Maryland HomeBuyer Transfer and Recordation Tax Addendum For use when. Recordation tax is an excise tax imposed by the state of Maryland for the. One-half of the 1.

What is Maryland Transfer and Recordation Tax. The grantee is a first-time Maryland home buyer as defined under subsection a of this section. In Maryland the transfer tax is a total of 1 of the sales price.

Make sure the data you add to the First Time Maryland Homebuyer Transfer And Recordation Tax Addendum is up-to-date and accurate. Save or instantly send your ready documents. State transfer tax recordation tax and local transfer tax 1.

Easily fill out PDF blank edit and sign them. Click on New Document and select the form importing option. If you arent acting as a FTHB youd pay half 6875.

If you use your FTHB benefits you pay 0 and seller still only pays his half he does not. Add FIRST-TIME MARYLAND HOMEBUYER TRANSFER AND RECORDATION TAX from your device the cloud or a. In most cases it is an ad valorem tax that is based on the value of the property transferred.

The residence will be occupied as the homebuyers principal residence. MD is 05 so total is 1375. Edit first time maryland homebuyer transfer and recordation tax addendum pdf.

Fill out each fillable area. There is an exemption that will allow a homebuyer to qualify if a co-buyer is on title solely for the loan. The residence will be occupied by the grantee as the grantees principal residence.

Indicate the date to. If you are purchasing your primary residence in Maryland for the first.

Maryland Transfer And Recordation Tax Table 2020 Pdf Refinancing Property Tax

As Is Addendum Maryland Fill Online Printable Fillable Blank Pdffiller

Maryland Transfer And Recordation Tax Table 2020 Pdf Refinancing Property Tax

Maryland Real Estate Contract Addendum Fill Online Printable Fillable Blank Pdffiller

First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Fill Out Sign Online Dochub

Maryland Transfer And Recordation Tax Table 2020 Pdf Refinancing Property Tax

1 A A

Title Insurance Resources Title Company Endeavor Title

First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf Fill Out Sign Online Dochub

Maryland Transfer And Recordation Tax Table 2020 Pdf Refinancing Property Tax

First Time Maryland Homebuyer Transfer And Recordation Tax Fill Out Sign Online Dochub

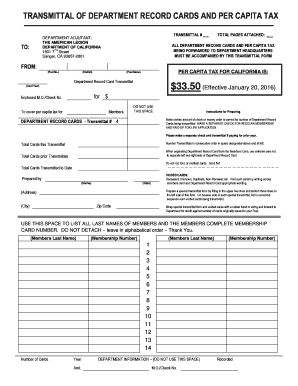

January 2021 Apartment News Magazine By Apartment Association Of Orange County Issuu

First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Fill Out Sign Online Dochub

First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Pdf Fill Out Sign Online Dochub

Md Transfer Recordation Chart Capitol Title Group

![]()

Md First Time Home Buyer Transfer Tax Credit Lexicon Title

First Time Maryland Homebuyer Transfer And Recordation Tax Addendum Fill Out Sign Online Dochub